Safeguard of cashflow is fundamental for any business and Creopay, the first “cash delivery” platform, helps companies solve all the diverse issues related to required payments.

Through the fintech app, the company creates a proprietary customer database from which it sends a direct payment link - which works with all the main payment circuits. This way, cash flow increases simply and rapidly, consequently improving the company’s profitability.

It is an effective and efficient way to help businesses grow quicker even in difficult moments, allowing them to digitize a critical process such as payments ad fiscal compliance, without having to spend large sums of money for this kind of service.

Whether it is dormant accounts, payment requests to activate a supply contract or even to cash in the rent, you only need a “digital” memo, sent via SMS or email, and a simplified and accessible procedure via a link to give the opportunity to the other party to safely settle heir account.

GreenVulcano Technologies is a high-profile company: we could realize a project from scratch and have it just like we wanted it

Antonio Fontanelli - CEO of Creopay #cashdelivery

The web cash in is universal and is provided with a custom POS. This can be activated immediately and it only takes a few minutes to through the process. This way, businesses can receive payments from all over the world in whatever currency.

Creopay is the ideal solution when it comes to the management of expired or recurring payments thanks to the opportunity to set up installment plans.

From debts to service subscriptions and even to most conventional invoice management with the possibility to set up automatic sending with the correct amount to be paid.

Creopay makes the contractual relationship smarter by relieving the user from bureaucratic stress and hardship and providing the payer with a lean, quick and comfortable payment solution on any device.

There no unnecessary costs in any part of the user experience and cashing in is quick and utterly traced. The product, moreover, is compliant with the Italian law for fiscal and banking matters. Debt reconciliation is instantaneous and automatically produces a receipt of payment to safeguard both the involved parties.

In the case of recurring use, the customer can also save the payment source for future operations - a very useful function when dealing with recurring customers of installments.

The fintech solution is extremely accessible and optimized:

- payment links are active 24/7.

- the platform is utterly on the cloud.

- processes are automatic and allow massive database management or to send single, instantaneous requests.

A quick and timely product you can connect to your payments with just a few clicks.

The use of the fintech app is an autonomous process in 4 stages:

- Activation of the account’s Cloud, fully secured and according to the GDPR regulation on data saved by the company.

- Creation of a “customer-debtor” list, a simple document the user can brand with his/her company’s name through the upload of .csv or .excel files.

- Payment requests (single, multiple or massive) individually or in installments.

- Timely and real-time reports of all the activities and of solved payments.

With what kind of customers can I use CREOPAY?

- Active customers that can use the various possible options for single payments or for installment plans, subscriptions or rents.

- Customers with expired accounts. You can send a link to pay via alternative, digital and quick payment sources if I problem occurred on the main source.

- Non-performing customers. Creopay allows for massive credit management companies to efficiently recover the payment and to identify operations and strategies for the next actions to implement on the database (thanks to the data analysis service provided on the platform).

GreenVulcano’s contribution to the realization of Creopay

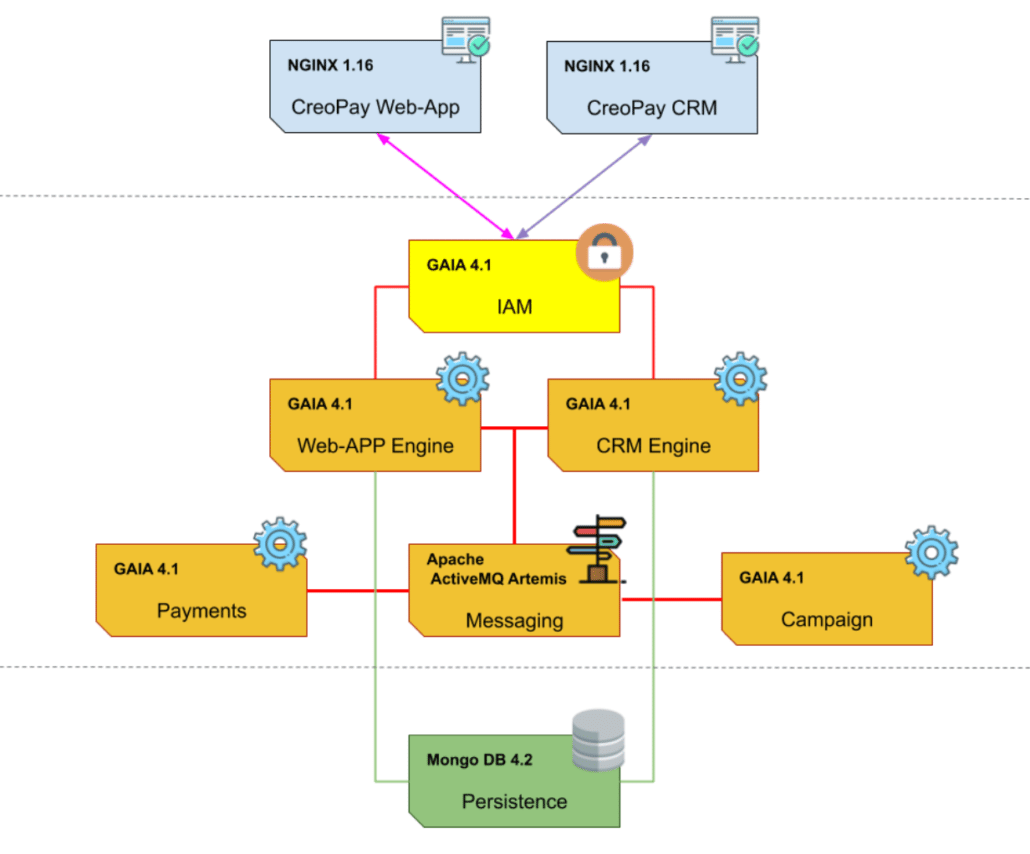

Creopay was one of the innovative projects GreenVulcano recently followed and supported. The project embraced both the application architecture and the creation of the manuals for managers and users.

The rebuilding of Creopay 2.0, designed by GreenVulcano Technologies, is a web-based, cloud-native, safe distributed and scalable application based on a multilevel architecture on three layers:

- Presentation

- Business services

- Persistence

The Presentation layer deals with the UI for all the activities carried out by human users and involves both the back-office and the user face for the end-users. The data of the Presentation layer are supplied by the Business services layer while further data are shared via API with third-party services.

The Business Services layer contains a set of loose coupling services following the principle of “Decompose by business capability”. APIs are listed according to safety and business functions in conjunction with event-driven processes. Automated and programmed tasks deal with the completion of Creopay 2.0’s business processes.

The Persistence layer contains a set of databases to safely store business information and metadata.

A final security layer deals with the IAM and secures the Presentation layer and all the following structure.

Creopay 2.0’s Architecture

Creopay 2.0’s architecture is based on PaaS (Platform as a Service) and cloud development and deployment environment. An infrastructure natively scalable and based on containers. It is a more efficient, quicker and lighter solution.

The container structure allows the application to be encircled in auto-consistent environments, ensuring an extreme deployment velocity, scalability and ease-of-use for porting among development environments, tests and production.

The platform allowing to create and execute Creopay 2.0’s container is Docker, an open-source, flexible and user-friendly platform. The architecture of the containers is regulated by monitoring servers that trigger the system and keep monitoring the execution of independent containers. The execution harmony among the various containers is ensured by solutions such as Kubernetes. Kubernetes is the leading product to manage medium and large architectures. It is an open-source project made by Google. This way, all the various, Linux-based containers make the application easy to distribute and scale according to whatever necessity with a high degree of abstraction.

The architecture designed for Creopay 2.0, thus, allows the fintech company to have a more efficient management of workloads.